2024 China Lithium Industry Development Report 3

Feb,03,24

On November 23, 2023, the Beijing Municipal Bureau of Economy and Information Technology issued the "Several Policy Measures to Support the Development of New Energy Storage Industry in Beijing", proposing to encourage new energy storage enterprises to focus on key areas such as long-life and high safety lithium-ion batteries, sodium ion batteries, flow batteries, compressed air energy storage, flywheel energy storage, etc., and accelerate the research and industrialization of key technologies, material components, and major equipment. Organize the implementation of the "foundation building project" for the new energy storage industry, focus on the key links in the industrial chain to carry out research and development, solve the bottleneck problem of key core technologies in the industry, and provide a maximum subsidy of 30 million yuan at a ratio not exceeding 30% of the research and development investment.

On December 15, 2023, the Energy Conservation and Comprehensive Utilization Department of the Ministry of Industry and Information Technology issued the "Management Measures for the Comprehensive Utilization of New Energy Vehicle Power Batteries (Draft for Comments)". It is proposed that during the design phase, battery production enterprises should use non-toxic or low toxicity and low harm raw materials as much as possible, adopt standardized, universal and easy to disassemble product structure design, code the power batteries produced according to the requirements of the "Code Rules for Automotive Power Batteries" (GB/T 34014), and provide power battery disassembly technical information to automobile production enterprises. Encourage battery production enterprises to prioritize the use of recycled raw materials and disclose the proportion of recycled raw materials used in power batteries. Comprehensive utilization enterprises should carry out multi-level and multi-purpose rational utilization of waste power batteries in accordance with relevant national and industry standards, and dispose of the waste generated during the utilization process in compliance with regulations.

On December 28, 2023, the Ministry of Industry and Information Technology, the National Development and Reform Commission, and other five ministries jointly issued the "Action Plan for Green Development of Shipbuilding Industry (2024-2030)", promoting the core technology research and development of low-carbon and zero carbon fuel marine engines such as methanol and ammonia fuel, forming the research and development capabilities of full power spectrum methanol and ammonia fuel engines, and achieving scale demonstration effects; Actively and prudently expand the application scope of fuel cells and power batteries in ships.

(2) Analysis of Industrial Structure Adjustment

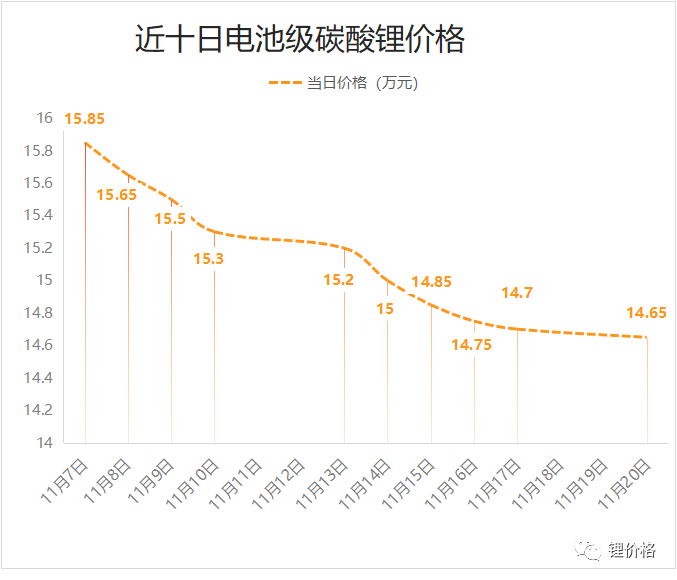

In 2023, the production and sales of new energy vehicles set a new historical record, coupled with the demand in the energy storage field, greatly promoting the construction of production capacity in the domestic lithium battery cathode materials and lithium salt industry. However, due to the significant decline in lithium salt prices in 2023, some lithium salt companies have incurred losses, and positive electrode material companies have suffered significant losses, resulting in overall poor performance in the lithium battery industry.

To promote the stable and healthy development of the lithium resource industry, and ensure the security and stability of the supply chain of industries such as new energy vehicles. At the beginning of 2023, the leaders of the Ministry of Natural Resources once again emphasized the current importance and urgency of strategic mineral resources. Regarding energy and resource security, the Ministry of Natural Resources has fully launched a new round of breakthroughs in mineral exploration and development, improved the management system for mineral exploration and extraction, and stimulated the vitality of the mining market. Geologists have explored several lithium resource projects in Sichuan, Henan, Xinjiang, Xizang, Inner Mongolia, Jiangxi, Hunan, Yunnan and other provinces and regions, and some ores have entered the mining stage. Nearly one million tons of lithium resources were discovered in Yajiang, Sichuan. The construction of the Aba Lijiagou Lithium Mine was basically completed, and the project of producing lithium hydroxide from the brine of Laguocuo Salt Lake in Xizang was completed and put into operation. More and more lithium battery companies are paying attention to upstream and downstream collaboration while driving development through innovation, participating in lithium resource development or waste battery recycling projects.

Solid state batteries are a new type of battery technology with advantages such as high energy density and fast charging. Once commercialized, they will greatly enhance the range and convenience of electric vehicles. In 2023, influenced by the installation schedule of Toyota's "solid-state lithium batteries" in Japan, domestic battery and vehicle companies began to focus on the research and investment of "solid-state lithium batteries". Some claimed to have made significant breakthroughs and will begin installation in the near future. In order to improve the energy density, rate performance, and cycle life of all solid state batteries, it is not only necessary to pay attention to the basic scientific issues of all solid state lithium batteries, such as new electrolyte materials, interface modification, and battery failure mechanisms, but also to pay attention to the key technical issues of all solid state batteries, such as batch production and preparation technology of electrolytes, continuous preparation technology of large-area solid electrolyte thin films, and integrated preparation technology of all solid state batteries.

Due to the high grade of lithium resources abroad and their ease of development, Africa, South America, and other regions have become hot spots for lithium resource development. In 2023, three lithium mines in Zimbabwe, Africa, began large-scale production, and two lithium extraction projects from salt lakes in Argentina were put into operation. The lithium hydroxide production line for spodumene in Australia was completed for trial production, and the lithium hydroxide production project for spodumene in South Korea was completed by the end of the year.

Affected by policies such as the US and Western Inflation Reduction Act, the EU Key Raw Materials Act, and the EU Battery and Waste Battery Act, countries such as the US, EU, Australia, Japan, and South Korea are actively building the lithium battery industry chain, aiming to enhance their strategic autonomy in key raw materials and reduce dependence on a single third-party country.

(3) Analysis of Business Situation

According to predictions from multiple domestic and foreign institutions, the shipment volume of lithium batteries will reach 2176GWh in 2025, an increase of 147.2% compared to 2022, including 1690GWh for power batteries and 520GWh for energy storage batteries. It is expected that the global demand for lithium batteries will exceed 4TWh by 2027, with an average annual growth rate of over 30% from 2023 to 2027. In the coming years, the global demand for lithium battery products will continue to maintain a high growth rate.

Wan Gang, Chairman of the China Association for Science and Technology and President of the World New Energy Vehicle Conference, emphasized at the December 2023 World New Energy Vehicle Conference that the global automotive industry should strengthen its confidence in comprehensive electrification development, continue to expand opening up and cooperation, and jointly create a new pattern of global development of the automotive industry with smooth circulation and mutual benefit, making positive contributions to global green economic growth and achieving carbon neutrality goals.

Under the global goal of carbon neutrality, many countries have made the development of new energy vehicles one of the core strategic emerging industries, and some countries have announced that they will gradually replace gasoline vehicles to increase the penetration rate of new energy vehicles. Countries have firm confidence in achieving a global market share of over 50% for new energy vehicles by 2035, and will focus on the development of pure electric vehicles, plug-in/extended range hybrid vehicles, and fuel cell vehicles. They will continue to promote the research and development of diverse energy power technologies such as efficient and safe power batteries, high-efficiency internal combustion engines and carbon neutral fuels, and wide temperature range fuel cells. They will strengthen the construction of charging and swapping, hydrogen energy infrastructure, and strive to achieve this development goal ahead of schedule. The development of the new energy vehicle industry has greatly promoted the development of the lithium battery industry, bringing positive impacts to enterprises engaged in lithium resource development, lithium salts, positive electrode materials, lithium batteries, and lithium battery supporting equipment.

For many years, the production and consumption of China's lithium industry have ranked first in the world, accounting for about two-thirds of the world's lithium production and consumption. Every year, a large amount of lithium concentrate raw materials are imported and processed domestically into lithium carbonate, lithium hydroxide, lithium battery materials, and lithium batteries for use in multiple countries around the world, meeting the needs of multiple countries for lithium batteries and facilitating people's travel, communication, entertainment, and life needs. The generalized national security concept of a few countries poses many challenges for Chinese enterprises in overseas lithium resource development and domestic lithium product exports. At the same time, policies and regulations related to new energy vehicles and lithium batteries in countries such as the United States and Europe have also increased the difficulty and uncertainty of China's deep participation in international industrial and supply chain cooperation.

four

Issues that need attention in the current development of China's lithium industry

In the past two years, China has accelerated the development and approval of domestic lithium resource projects, and some high-quality and large reserves of lithium resources have begun to be effectively developed. The completed production capacity will gradually be released after 2024. At the same time, due to multiple domestic enterprises holding shares in multiple lithium mines abroad, their large-scale investment also needs to be guaranteed and rewarded. It is necessary to import high-grade lithium raw materials to meet domestic smelting capacity. At the same time, multiple foreign-funded enterprises have established large-scale production capacity in China and also need to import spodumene concentrate. At present, the lithium resources in salt lakes in Qinghai have been well developed and utilized. Under high lithium prices, some low-grade lithium resources have been exploited and utilized. For example, the lithium resource utilization in Yichun, Jiangxi has achieved good results, although there are still some problems that need to be solved. With the sustained explosive growth of the new energy vehicle market and the increasing global attention to environmental protection and sustainable development issues, the demand for lithium battery recycling industry is showing a surge trend.

China's lithium battery industry has had an early layout and has achieved leadership in technology research and development, equipment manufacturing, product quality, and many other aspects. However, the following issues still need to be addressed:

(1) The degree of lithium resource development and utilization is not high, and the construction scale needs further optimization.

There are many projects in China that have lithium resource mining certificates, but there are relatively few projects that actually produce production through mining. Some salt lake lithium extraction enterprises need to further rapidly expand their lithium salt production capacity and improve the utilization rate of lithium resources. Xizang is rich in lithium resources in salt lake brine, but except for Zabuye Salt Lake, the development and utilization of lithium resources in other salt lakes is too slow and is still in the stage of development preparation. The development of proven lithium resources in the Garze, Aba regions of Sichuan and Xinjiang has just begun, and the scale of completed mines is relatively small. At the same time, the development of salt lake resources in the Xizang Autonomous Region needs to solve the problems of energy supply, traffic road construction, resource development and environmental protection.

(2) The production capacity of lithium battery materials is expanding rapidly, far exceeding actual demand.

Positive electrode materials and electrolytes are the core key materials of lithium-ion power batteries, and both upstream and downstream enterprises in the industry have the possibility of entering these fields. In the past two years, multiple enterprises in the titanium dioxide, phosphorus chemical, fluorine chemical, and electrolyte industries have entered the lithium iron phosphate and lithium hexafluorophosphate industries, with large-scale investment projects. In the face of the decline in lithium salt prices, the competition in the lithium iron phosphate and lithium hexafluorophosphate industries has intensified. There has been a serious supply-demand imbalance in the lithium battery industry and supply chain in China, with some intermediate products and materials experiencing price fluctuations exceeding the normal range. A few enterprises simply expand their production capacity and invest insufficient in technological innovation, research and development, improving product quality, and reducing production costs. The planned production capacity under construction is several times larger than the existing capacity and far exceeds the actual downstream demand, which will seriously affect the healthy development of the industry in the future.

(3) The lithium battery industry should take the path of intelligent, green, low-carbon and environmentally friendly development.

As one of the high-tech industries, intelligence is an important guarantee for the upgrading and technological progress of the lithium battery industry. Intelligence can provide strong support for enterprises to compete in the international market and increase the international competitiveness of lithium battery products. The lithium battery industry can only seize the new opportunities brought by intelligence, use modern information technology to improve the management level of lithium battery production enterprises, enhance the safety level of production lines, and minimize various hidden dangers in the production and sales process of lithium battery products. At present, some enterprises have introduced advanced automated production lines, including automated handling, assembly, and testing systems, which have improved the stability and efficiency of production lines; Adopting robot technology to achieve flexible manufacturing and customized production, improving flexibility and adaptability, while reducing labor costs; By utilizing digital twin technology, a real-time production environment model can be created to simulate and optimize the production process, reducing the time and cost of production line adjustments.

The new energy vehicle industry, as an important sector in addressing global climate change, has attracted much attention, and lithium-ion batteries, as the core component of new energy vehicles, have rapidly developed. Key lithium raw materials and lithium battery cathode materials are the most crucial raw materials for power lithium batteries, which are of great significance in empowering the green, low-carbon, and sustainable development of the new energy vehicle industry. In the era of low-carbon economy, developed countries have proposed new terms such as "carbon labels" and "carbon tariffs", which have become new trade barriers and will have adverse effects on the foreign trade of developing countries. In order to cope with carbon trade barriers, enterprises should reduce energy consumption, improve production technology, and achieve low-carbon utilization of high carbon energy through technological innovation, energy conservation and emission reduction, achieving low-carbon export products and fundamentally avoiding foreign carbon trade barriers. Low carbonization can also promote technological innovation, emission reduction, and consumption reduction in enterprises. At the same time, it can also meet the purchasing tendencies of customers and consumers in some developed countries and regions in Europe and America. While addressing climate change, the global low-carbon economy is constantly developing, and low-carbon trade barriers will also become increasingly severe. Low carbon trade barriers will affect China's export trade for a long time in the future.

five

The next development focus of China's lithium industry

Relevant national ministries and local governments have introduced multiple policy measures for the development of the lithium battery industry, all aimed at promoting the healthy and sustainable development of the new energy and lithium battery industries. The upstream, midstream, and downstream of the lithium battery industry are an inseparable community with a shared future. We must resolutely implement the decisions and deployments of the Party Central Committee and the State Council, comprehensively implement various policy measures and requirements for stable industrial economic growth. Enterprises in the upstream, midstream, and downstream industries should strengthen communication and coordination, gather industry consensus, and strive to form a community with a shared future of value. Together, we should ensure supply and price stability, and promote coordinated and orderly development of the lithium industry chain.

Increase domestic exploration and development efforts, and formulate an overall plan for lithium resource development and industrial development. Encourage key regions to develop lithium resource industry plans and resource development project lists, strengthen policy support and factor guarantees, and accelerate project approval processes through the establishment of green channels and other means. The approval procedures for some lithium resource development projects are accelerating.

Encourage areas with conditions to carry out key technological breakthroughs and industrial trials such as efficient lithium and magnesium extraction from high salt lakes, and the consumption of lithium mica tailings. Accelerate the construction of a strategic mineral resource industry basic data platform to provide public services for enterprises to develop and utilize domestic and foreign mineral resources.

Support the research and application of key materials. Around the application fields of new energy vehicles, energy storage, energy conservation and carbon reduction, we will leverage the role of new material production and application demonstration platforms, manufacturing innovation centers, and other carriers to support the research and industrialization of high-end materials such as high specific energy cathode materials, and focus on the creation, application, and protection of high-quality intellectual property rights. Encourage various regions to adopt various forms of pilot platforms based on the characteristics of local industries, and promote the industrialization of research and development achievements in new materials and processes.

Support and encourage intelligent and green transformation. Fully promote green manufacturing, significantly improve the level of power battery equipment, utilize large-scale, highly intelligent, and energy-efficient equipment technology, and reduce energy consumption throughout the entire industry chain, including power battery materials, cells, battery systems, recycling, and reuse; Based on information and intelligent technology, promote the implementation of carbon footprint management in the power battery production system, promote the reduction of carbon intensity, and effectively control the total carbon emissions. Organize the implementation of the carbon peak implementation plan for the non-ferrous metal industry, focus on the low-carbon technology development roadmap, accelerate the promotion of green and low-carbon mature technologies, develop key common and disruptive technologies, and enhance the level of green development throughout the entire process. Support industry associations to carry out evaluations of green products and carbon footprint, and accelerate the development of systematic carbon emission management and technical standards.

笔记