The distribution, demand, supply, and development prospects of global lithium industry resources

Jul,30,24

Lithium is the lightest metal element in nature, with the chemical symbol Li. It is silver white in color and has a body centered cubic structure.

It ranks first among the IA group alkali metals in the periodic table and is the lightest and most reactive alkali metal.

Due to its unique physical and chemical properties, lithium can be used as a catalyst, initiator, and additive,

as well as for directly synthesizing new materials to improve product performance.

Due to its wide range of applications, it is known as the "industrial monosodium glutamate";

In addition, due to its highest standard oxidation potential among various elements, lithium is undoubtedly the best element in the fields of batteries and power supplies,

and is therefore also known as the "energy metal".

(1) Distribution of lithium resources

Due to continuous exploration, the identified lithium resources have significantly increased globally.

According to the data from the U.S. Geological Survey's (USGS) "MINERALCOMMODITYSUMMARIES2024",

as of the end of 2023, the total global lithium resources are approximately 105 million tons,

with the specific distribution as follows:

Bolivia 23 million tons; Argentina 22 million tons; 14 million tons in the United States;

Chile has 11 million tons; Australia 8.7 million tons; China has 6.8 million tons; Germany 3.8 million tons; Congo (Kinshasa) 3 million tons; 3 million tons in Canada;

Mexico 1.7 million tons; 8 million tons from other countries; The global total is approximately 105 million tons.

According to the data from the U.S. Geological Survey's (USGS) "MINERALCOMMODITYSUMMARIES2024",

as of the end of 2023, the global lithium resource reserves are approximately 28 million metal tons, with the specific distribution as follows:

1.1 million tons of metal in the United States; Argentina has 3.6 million tons of metal; 6.2 million tons of metal in Australia;

Brazil has 390000 tons of metal; 930000 tons of metal in Canada; Chile 9.3 million tons of metal; 3 million tons of metal in China;

Portugal 60000 tons of metal; Zimbabwe has 310000 tons of metal; 2.8 million tons of metal from other countries;

The global total is approximately 28 million tons of metal.

(2) Supply and demand situation in the lithium market

① Supply of lithium resources

According to data from the United States Geological Survey (USGS),

global (excluding the United States) lithium resource production has significantly increased from 32000 tons in 2014 to 185000 tons in 2023.

The supply of lithium raw materials is mainly concentrated in Australia, Chile, China, and Argentina.

In 2022, the production of lithium raw materials reached nearly 90% of CR3.

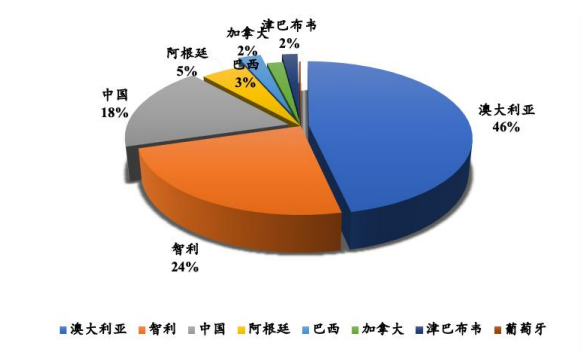

Among them, Australia's production of lithium through ore extraction accounts for 46%, making it a major global supplier of lithium raw materials;

However, Chile, which mainly extracts lithium from salt lakes, only accounts for 24% of the global total production.

According to data from the United States Geological Survey (USGS), the specific distribution of global (excluding the United States) lithium mine production in 2023 is as follows:

Source: United States Geological Survey Note: Excluding the United States.

However, from the perspective of the existence of lithium resources, lithium resources in nature mainly exist in two forms: salt lake brine and pegmatite.

The proportion of lithium resources in enclosed basin brine and pegmatite accounts for about 58% and 26% of the total reserves, respectively.

Salt lakes are the main reserve of lithium resources.

At present, there are problems in the global lithium industry such as excessive concentration of Australian resource supply and mismatch between reserves and supply entities.

With the increasing demand for lithium and the continuous improvement of lithium extraction technology from salt lakes,

it is expected that salt lake brine type lithium resources will be focused on development under the strategic needs of diverse types and supply guarantee.

② The demand for lithium resources

Lithium products have a wide range of applications, with traditional application areas being additives for glass and metallurgical products.

Since the 1990s, with the global trend of new energy, new material development and technological progress, as well as the emphasis on health technology,

the new applications of lithium products have also received increasing attention.

In the field of new energy, lithium is mainly used in the production of primary high-energy batteries, secondary lithium batteries, and power lithium batteries;

In the field of new pharmaceuticals, lithium is mainly used as a key intermediate in the production of statin lipid-lowering drugs and new antiviral drugs;

In the field of new materials, lithium is mainly used in the production of new synthetic rubber, new engineering materials, ceramics, rare earth smelting, etc.

Thanks to the excellent energy storage properties of lithium,

new energy batteries are the main application field of lithium products, and lithium batteries are currently the most widely used batteries.

With the rapid growth of production and sales of new energy vehicles, the demand for lithium resources has significantly increased.

As of now, the penetration rate of new energy vehicles in China is still at a relatively low level, which will further promote the sustained growth of lithium resource demand.

In addition, the continuous expansion of the energy storage field is also a key driving factor for the growth of lithium resource demand.

(3) Industry development prospects

Compared with lithium extraction from ores,

lithium extraction from salt lakes has lower production costs, but there are still problems such as long production cycles and poor capacity guarantee.

With the continuous development and maturity of technology, the future will focus on developing salt lake lithium extraction, with the main development direction being:

Firstly, the mining scope continues to expand: the development and utilization of low concentration, high magnesium lithium ratio salt lake brine,

which was previously uneconomical, can be achieved through technologies such as membranes, adsorbents, extraction, and electrodialysis;

Secondly, the guarantee of production capacity continues to improve: Currently, lithium extraction from salt lakes mainly adopts the concentrated precipitation method,

which is affected by natural environmental factors such as weather. In the future, plans are being made to reduce external environmental constraints through emerging technologies;

Thirdly, the production cycle continues to shorten: optimizing and improving processes such as enrichment, separation,

and concentration, utilizing continuous industrial production to improve efficiency.

For more industry research and analysis, please refer to the official website of Sihan Industry Research Institute.

At the same time,

Sihan Industry Research Institute also provides consulting services such as industry research reports,

feasibility studies, industrial planning, park planning, business plans, special research, architectural design, overseas investment reports, etc.