Lithium Source Battle: Global Lithium Resource Distribution and Supply Demand Trends

Jul,31,24

Lithium is the lightest and most electronegative metal in the world, with a density of 0.53g/cm3,

a melting point of 180.5 ℃, a conductivity of 11.2, and an electronegative equivalent of 2.98A · h/g.

It accounts for 0.0065% of the Earth's crust and ranks 27th in abundance, playing an important strategic role in the energy sector.

The upstream supply of lithium resources mainly comes from salt lakes (brine), spodumene, and lithium mica.

The three main lithium resources each have their own advantages, among which spodumene has a higher grade, salt lake reserves are larger, and the cost of lithium mica is lower.

Lithium resources can improve product performance in traditional industries such as glass manufacturing and healthcare where demand is relatively stable.

For example, industrial grade lithium carbonate can enhance the strength and toughness of glass.

In the rapidly growing field of new energy, lithium resources can be used to prepare positive and negative electrode materials, electrolytes, etc.,

forming high-energy density lithium batteries, which has become the mainstream technology route.

It can be said that lithium is an important strategic resource with a relatively complete industrial chain layout.

1、Analysis of Lithium Resource Supply Situation

① Overseas lithium resource supply situation

According to data from the United States Geological Survey (USGS), the global proven lithium reserves in 2023 are estimated to be around 98 million tons,

while the current global demand for lithium carbonate is estimated to be around 1 million tons per year.

Therefore, lithium reserves are relatively abundant, and there is enormous potential for exploration and storage expansion in many regions.

The global lithium resources are mainly distributed in Chile, Australia, Argentina, China, and the United States, with the combined lithium reserves of the five countries accounting for over 80%.

From the distribution of resources across continents, Australia is rich in lithium resources,

mainly consisting of spodumene mines, represented by large mines such as Greenbushes and Pilgangoora,

with the largest Greenbushes producing approximately 7.43 million tons. The average grade is greater than 1.00%, and the highest grade ore is Greenbushes, reaching as high as 2.00%.

The cost advantage of Australian mines is evident globally, with Greenbushes being the lowest cost lithium mine at approximately 41000 yuan/ton.

Africa has a large amount of unmined lithium mines, represented by mines such as Manono and Goulamana,

mainly distributed in Zimbabwe and Mali, with the largest being Manono, which has about 520000 tons.

The average grade is greater than 1.00%, and the highest grade ore is Sabi Star Lithium Tantalum Mine, reaching up to 1.98%.

The types of lithium mines in the Americas and Canada are relatively complex, including spodumene mines, lithium clay mines, etc.

Represented by mines such as North American Lithium and James Bay, most projects have not yet been constructed and are mainly distributed in Canada and the United States.

The average grade varies greatly, with Tanco having the highest grade of 2.44%.

The cost range for mines in the Americas and Canada this year is about 50000 to 70000 yuan/ton, with the lowest cost being Mibra, which costs about 50000 yuan/ton.

South America has a large number of salt lakes and abundant reserves, represented by large salt lakes such as Atacama and Olaroz,

with over 25 ongoing/planned projects mainly located in Argentina.

The largest Atacama (SQM) weighs approximately 45.51 million tons. The highest lithium concentration is Atacama (ALB), reaching up to 1962mg/L.

The cash cost range for salt lakes produced in South America this year is about 30000 to 70000 yuan/ton, with the lowest cost being Atacama (SQM), which is about 32000 yuan/ton.

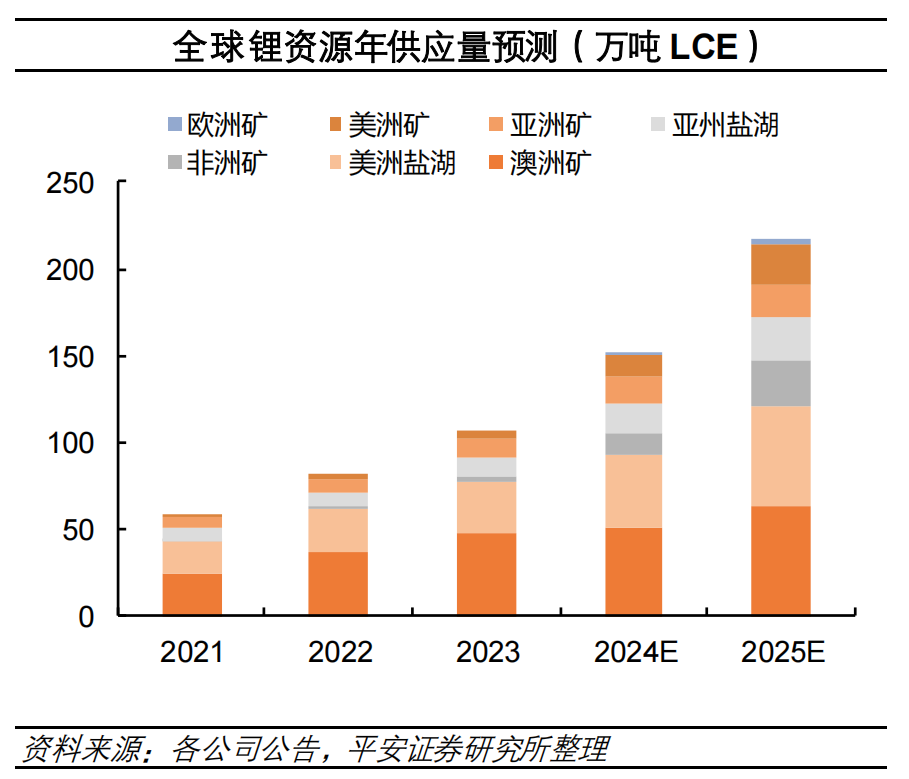

According to third-party institutions' predictions,

the global supply of lithium carbonate from 2024 to 2025 will be approximately 1.41 million tons and 1.86 million tons,

with an additional 380000 tons added in 2024, mainly from non mineral contributions, reaching up to 130000 tons, followed by an additional 100000 tons from overseas salt lakes;

In 2025, an additional 450000 tons will be added, mainly from non mineral contributions, reaching up to 110000 tons, followed by approximately 108000 tons from Australian mines.

② Domestic lithium resource supply situation

According to USGS data, the consumption of lithium resources in China has reached 505000 tons in 2022, accounting for 81% of the global total,

while the production of 100000 tons accounts for only 15% of the global total.

For many years, China has been the country with the largest consumption of lithium resources in the world, with a significant supply-demand gap.

Therefore, China is highly dependent on imports, with an external dependence rate of over 70%.

The vast majority of imports come from Australia, accounting for 92% in 2022, with a few coming from Brazil, Zimbabwe and other regions.

Domestic salt lakes, represented by large salt lakes such as Qarhan Salt Lake and Zabuye Salt Lake,

are mature and have been expanding production, mainly distributed in Xizang and Qinghai,

with reserves ranging from 1.44 million tons to 4.40 million tons. The largest salt lake is Qarhan Salt Lake (salt lake shares), with about 4.4 million tons.

The highest lithium concentration is in the Eight Thousand Co Salt Lake, reaching 2153mg/L, and the lowest is in the Longmucuo Salt Lake, at 130mg/L.

According to rough estimates, the cash cost range for domestically produced salt lakes this year is about 30000 to 55000 yuan/ton,

with the lowest cost being Cha'erhan Salt Lake (Salt Lake Co., Ltd.), which is about 31000 yuan/ton.

The main domestic spodumene mines include Lijiagou Mine and Methyl Card No. 134 Vein.

The largest reserve is the wood wool lithium mine, with approximately 2.45 million tons.

The overall grade of the mines is above 1.0%, with the highest grade being the wood wool lithium mine, reaching 1.62%.

The lowest cost of spodumene mining is in Yelonggou, at only 45000 yuan/ton.

There are domestic lithium mica mines such as Huashan Porcelain Stone Mine and Jianxiawo Mining Area.

The largest reserve is in the Jianxiawo mining area, with approximately 2.66 million tons.

Most of the mines have a grade of over 0.3%, with the highest grade being Gabus niobium tantalum ore, which reaches 0.57%.

Among them, the Huashan Porcelain Stone Mine has the lowest cash cost, about 55000 yuan/ton.

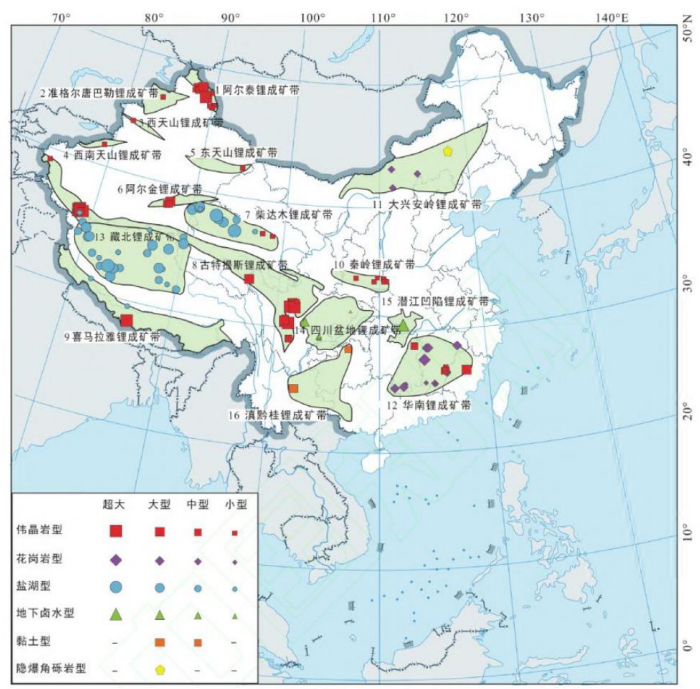

Distribution of lithium resources in China

2、Demand situation and price outlook

Before 2015, lithium was mainly used in traditional industries such as glass and ceramics.

Since 2015, sales of new energy vehicles have accelerated due to policy subsidies,

and the increasing demand for power batteries has led to a restructuring of the lithium demand side.

The industry has ushered in more than a decade of demand growth opportunities.

Since 2015, lithium prices have gone through two major cycles.

In the first round of 2017, the highest price rose to 170000 yuan, and then fell back to around 50000 yuan.

At the end of 2022, the highest amount reached nearly 600000 yuan in the second round, and dropped to less than 100000 yuan a year later.

From the perspective of the lithium price cycle,

the pace of supply release determines the duration of the lithium price cycle, with rising and falling cycles often lasting 2-3 years,

which is equivalent to the cycle time of lithium resource projects releasing supply increments.

According to third-party institutions' predictions, global sales of new energy vehicles will reach 15.92 million

and 19.55 million units respectively, an increase of 20% and 23% respectively, from 2024 to 2025.

Overseas sales of new energy vehicles will be 6.03 million and 8.13 million units respectively, an increase of 18% and 35% year-on-year;

Domestic sales of new energy vehicles were 9.46 million and 10.88 million respectively, with year-on-year increases of 22% and 15%.

The global demand for installed power batteries is expected to reach 796GWh and 1039GWh in the next two years, an increase of 22%/31%.

The demand for installed energy storage batteries is expected to reach 282/400GWh, an increase of 41%/42% year-on-year.

The demand for lithium carbonate is expected to reach 1.08 million tons and 1.35 million tons, an increase of 19%/25% year-on-year.

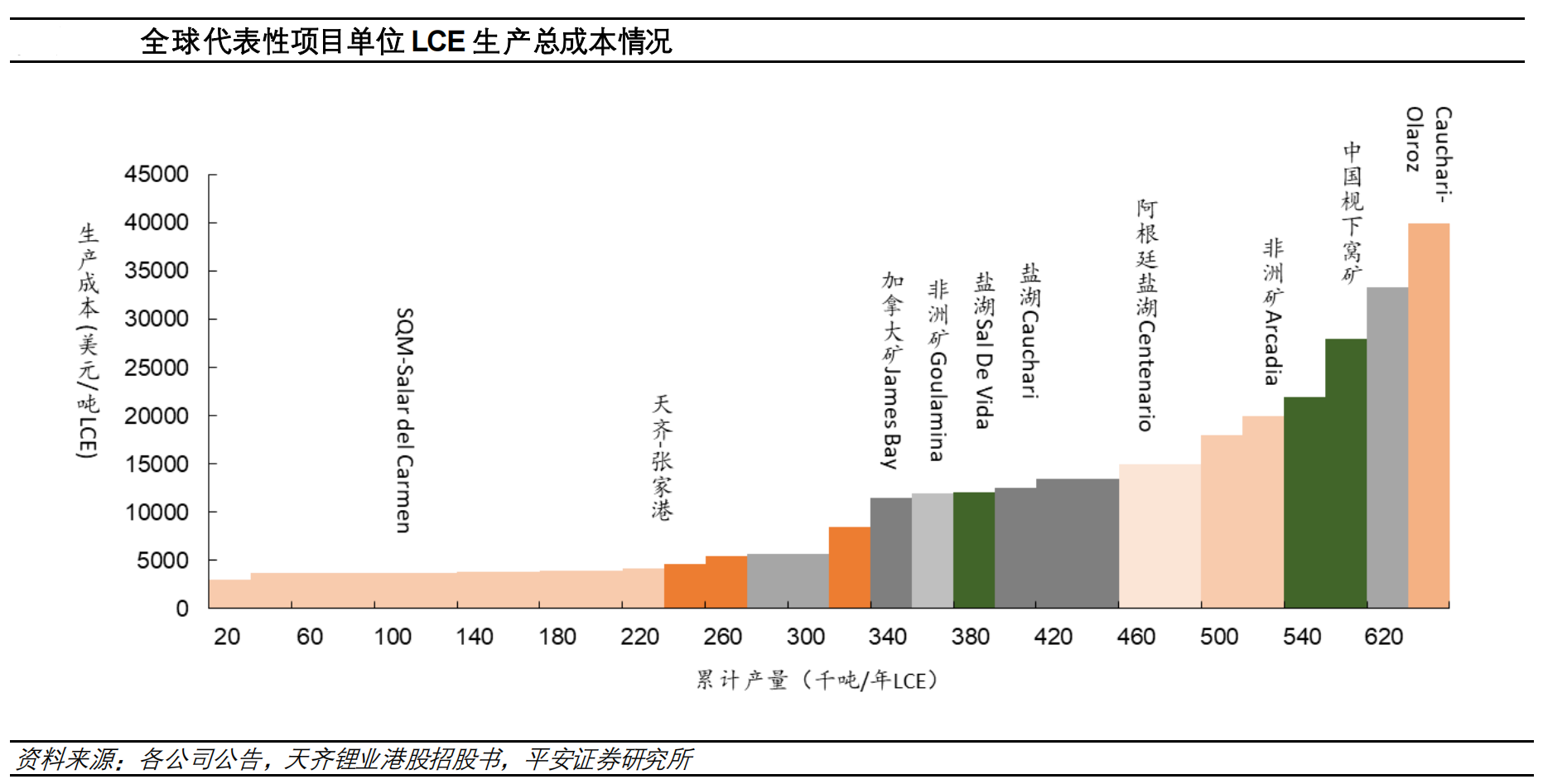

In 2024, the high cost production capacity will mainly be African lithium ore and domestic mica ore production capacity, accounting for about 20% of the supply.

Except for Goulamana and Sabi Star, all other non mining cash costs are above 60000 yuan;

Except for Huashan Porcelain Stone Mine, the cash cost of other mica mines is over 70000 yuan.

The corresponding cash cost for lithium carbonate demand in 2024 is around 60000 yuan, and the low point of lithium prices in 2024 may be below 70000 yuan.

The price center is expected to return to 70000 to 80000 yuan.

From the perspective of global quarterly supply and demand, based on a one month difference between terminal sales and lithium carbonate supply,

the excess supply in the first quarter of 2023 is estimated to be around 25000 tons, then maintained at around 30000 tons, decreased to around 5000 tons in the third quarter,

and expanded to 35000 to 40000 tons in the fourth quarter; In the first quarter of 2024, the supply increased by nearly 50000 tons, and then the situation of oversupply slightly eased.

In next year's supply increment, about 270000 tons of new supply cash costs will be below 60000 yuan, mainly from Australian spodumene mines and South American salt lakes;

The increase in demand for lithium carbonate next year will also be around 270000 tons,

which means that if the production capacity that is losing cash costs this year is shut down, reduced, or the construction progress slows down, lithium prices may stabilize next year.

3、epilogue

The current growth rate of lithium resources is slowing down, mainly due to the active reduction of production and destocking by Australian mines.

The production ramp up in South America and China is relatively slow, while in Africa, although the increase is significant, the absolute amount is limited.

The short-term supply of lithium resources remains stable, and there are currently no major concerns about supply.

However, as the global demand for renewable energy and electric vehicles continues to grow, competition for lithium resources is becoming increasingly fierce.

With the increasingly difficult channels for obtaining overseas resources in our country, the demand for self-protection of strategic minerals is becoming stronger.

Our country's lithium industry chain and practitioners need to continue optimizing the mining and extraction technology of salt lakes, spodumene, and lithium mines,

as well as the layout of mineral resources within the country.

Under policy guidance, we need to enhance the competitiveness of the industry from the perspective of the entire industry chain.