Research framework for lithium carbonate

Aug,06,24

1、Introduction and process flow of lithium carbonate

Lithium Carbonate, with the chemical formula Li2CO3 and a molecular weight of 73.89, is a colorless monoclinic crystal.

It is slightly soluble in water and dilute acid, but insoluble in ethanol and acetone.

Lithium carbonate is the main raw material for producing lithium hydroxide,

and although there may be temporary deviations in their price trends in the short term,

there is a strong correlation in the medium to long term.

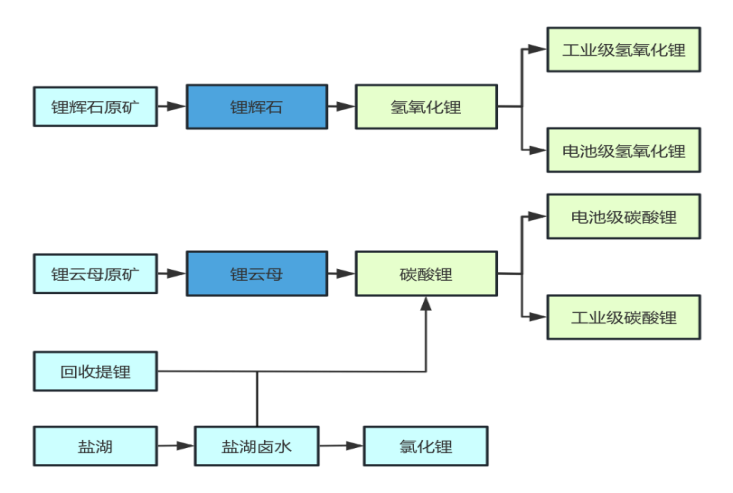

Lithium salt process flow

There are generally two methods for producing industrial grade lithium carbonate: one is to use traditional lithium ores such as spodumene and lithium mica for production,

and the other is to use lithium containing brines such as salt lake brines and underground brines for production.

Among these methods, the comprehensive cost of salt lake lithium extraction process is relatively low.

2、Supply and demand relationship of lithium carbonate

Supply situation of lithium carbonate

About 65% of the global lithium resources are found in liquid lithium mines, while approximately 36% are found in solid lithium mines.

Liquid lithium ore is a lithium containing solution, including enclosed basin brine, oilfield type brine, geothermal brine, etc.

Solid lithium ore mainly includes spodumene, lithium mica, lithium feldspar, lithium clay, etc.

Lithium pyroxene has the highest lithium content, with a grade of up to 6%.

The grade of lithium mica raw ore is between 0.3-1.2%, and the grade of clay ore is generally between 0.5-1.0%.

According to USGS data, as of 2022, the world's proven lithium reserves are mainly distributed in the South American Lithium Triangle (Bolivia, Chile, Argentina),

Australia, the United States, China, and other places; Chile, Australia, and Argentina account for approximately 41%, 25%, and 10% of the global market share, respectively.

China's total lithium resources are 36.17 million tons of lithium carbonate equivalent, accounting for about 6%.

From the perspective of production enterprises, apart from Chinese enterprises,

overseas lithium carbonate is mainly concentrated in four companies, namely American Yabao ALB, Chilean Mining and Chemical SQM, American Livent, and Australian Allkem.

According to the planned production capacity of major lithium mining companies, the supply of major mines is expected to exceed 2.5 million tons of LCE by 2025.

From 2023 to 2025, the supply of mining resources will maintain a high average annual growth rate, and the supply of lithium resources will be relatively sufficient

Downstream demand for lithium carbonate

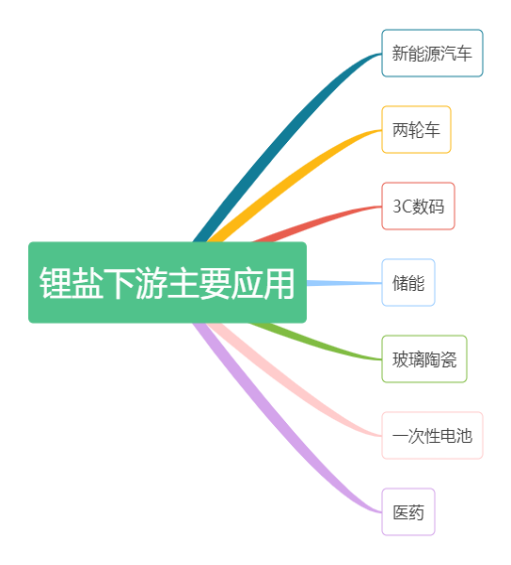

The downstream of the lithium carbonate industry chain is divided into fields such as power batteries, energy storage, consumer electronics, and traditional applications.

From the downstream consumption structure of global lithium carbonate in 2022, the demand for new energy vehicles accounts for more than half,

while traditional industries and consumer electronics each account for about 20% of global lithium carbonate consumption.

The development scale of energy storage batteries using lithium carbonate as raw material is still in its infancy worldwide.

In the long run, with the promotion of new energy generation and energy storage models,

energy storage batteries are expected to become a new consumption pillar for lithium carbonate in the future.

Research framework for lithium carbonate

As of the end of 2023, there are 8 mines in production in Australia.

The total production of spodumene in Australia in 2023 is 396000 tons of LCE, a year-on-year increase of 33%;

The total sales volume is 374000 tons; Year on year growth of 26%, overall in a state of accumulated inventory.

Looking ahead to 2024, most mines will see an increase, and Australian mines will remain the main contributor to global lithium resources.

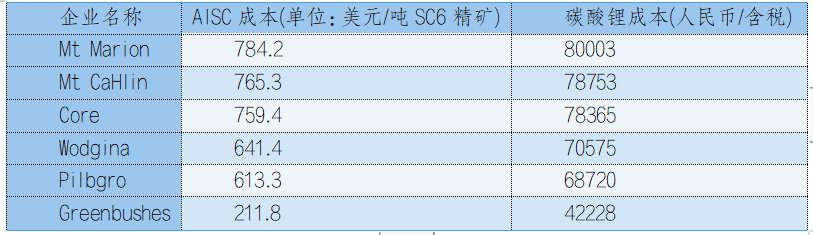

Due to the decline in lithium carbonate prices, Australian mining company Core announced production cuts on December 22, 2023,

and in January 2024, Core announced production shutdowns, without falling below its cash cost of $759.4 per ton.

According to publicly available information,

the highest cost project for Australian mines currently is the Mt Marion lithium mine, with a corresponding cost of $784.2 per ton of concentrate.

The lowest project is the Greenbushes mine under Tianqi, with a cost of $211.8 per ton.

(Note: The cost calculation here is based on the disclosed costs of various Australian mining companies in FY23H2,

with process cost markup from lithium concentrate to lithium carbonate).

According to research, the minimum cost of lithium carbonate in Qinghai Salt Lake is 30000 to 40000 RMB per ton.

During the downward period of the cycle, mining companies prefer to reduce supply by reducing or stopping production.

Table: Cost estimation of lithium carbonate from major Australian mines

4、summary

The price of resource products, cash expenditure costs determine the lower limit, and supply and demand determine the upper limit.

To determine the price of lithium carbonate, we need to focus on downstream demand, upstream salt lake supply from mines, and capital expenditure costs.