Chicago Board of Trade will launch cash futures contract of spodumene Ore

Oct,04,24

Chicago Board of Trade will launch cash futures contract of spodumene Ore

The Chicago Board of Trade plans to launch a futures contract for a new lithium material on October 28th, in response to the surge in demand and significant market fluctuations in the liquidity of battery metal trading.

CME Group Co. will launch a cash-settled futures contract for spodumene, which will be the world's first contract for this raw material  that plays a key role in the electric vehicle revolution.

that plays a key role in the electric vehicle revolution.

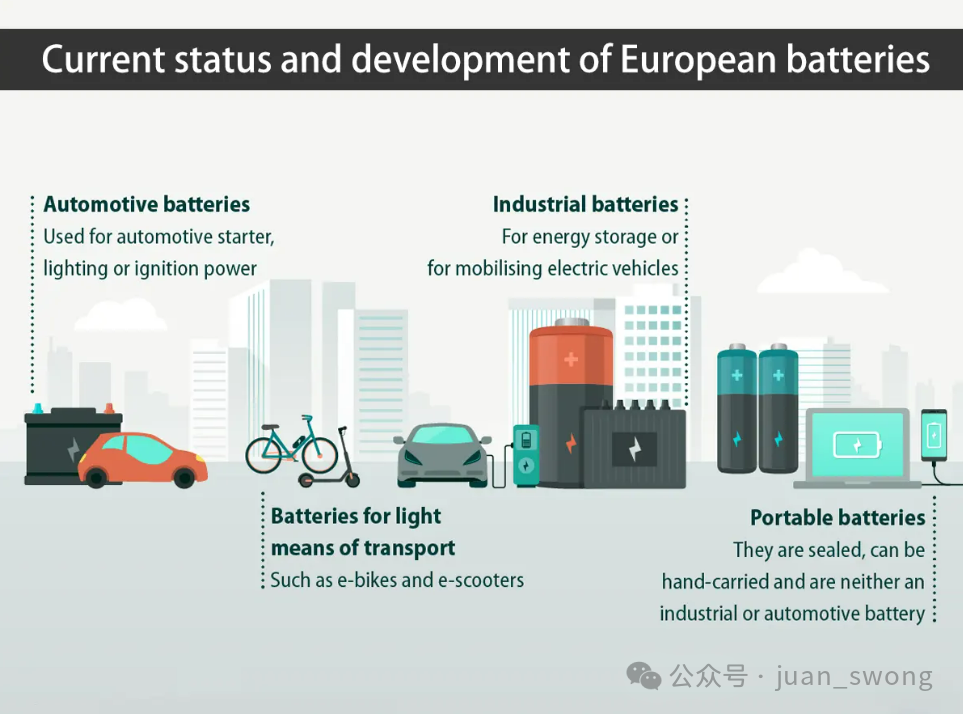

With the surge in demand for batteries in the fields of electric vehicles and energy storage, lithium has transformed from a marginal metal to a closely watched commodity in the market, attracting billions of dollars in investment. However, this rapid development has also brought complexity, and the market has an increasing demand for transparency in pricing different lithium products.

Przemek Koralewski, the global head of market development at Fastmarkets, pointed out that as spodumene miners increase production, trading activity in the spot market also increases. The prices of spodumene and lithium chemicals have often been disconnected in the recent past, so it is necessary to launch a dedicated spodumene futures contract in order to enable market participants to more accurately manage their risks and exposures.

CME Group launched this new contract at a time when the trading volume of its lithium hydroxide futures has grown rapidly in recent months, with open interest contracts constantly hitting new highs. It is said that this number exceeded 30,000 contracts for the first time this year, and the contract period has been extended to 2026.

As the world transitions to a greener future, the long-term demand for battery metals seems to be growing. However, due to oversupply, lithium prices have fallen in the past few years, leading to stagnation of many projects, cancellation of transactions, and reduced production. The spot price of lithium carbonate in China has fallen by more than 85% from the peak in 2022.

Grant Donald, chief commercial officer of Liontown Resources Ltd., said in an interview, "When the profit margin of the entire lithium value chain is squeezed, hedging and other risk management tools become particularly important. Currently, if you want to hedge, you have to operate on a chemical basis."

Buyers, sellers, and investors are flocking to the futures market to hedge their exposure, a trend that could bring about fundamental changes in the industry's approach to price risk management. At the same time, this also provides the possibility for financial participants to seek arbitrage opportunities in China's local lithium carbonate exchanges.

The spodumene contract will enable refiners to hedge price risks associated with their physical products, especially for those refiners that are not vertically integrated, in order to manage their refining margins, said Fastmarkets' Koralewski. "Speculators will have a tool to evaluate the difference between the prices of spodumene and lithium chemicals."

Long-term contracts are usually associated with the downstream chemical market rather than directly related to spodumene raw materials. Spodumene, as the main lithium resource, has gradually emerged in the past decade. As the supply chain continues to mature, the price link between spodumene raw materials and downstream chemical markets is gradually weakening.