China Lithium Battery (2024) Top 50 Financial Health Leaders

Jul,26,24

The real modern business history has already told us that financial health is the most fundamental cornerstone for the sustained survival and development of enterprises at any time.

In the past 20 turbulent years, countless star companies and even industry giants have gone bankrupt due to debt problems,

such as Hainan Airlines and Evergrande, which were once strong but later fell into bankruptcy and reorganization, serving as lessons from the past;

Looking at the 20-year development history of China's lithium-ion battery industry, especially in the past decade, the Chinese power battery industry has undergone several rounds of crazy and brutal growth and reshuffling.

During the craziest period of the industry, such as between 2013 and 2016, domestic power battery companies rapidly grew from over 40 to over 200, with the number of players increasing more than fourfold in a few years.

But with the adjustment of policies and market cycles, the power battery industry has also undergone a brutal reshuffle.

According to statistics from Dongfang Securities, in just the past five years, China's power battery industry has experienced a major reshuffle,

and the number of battery production enterprises capable of supporting vehicle models has decreased from 81 in 2017 to 36 (as of April 2023), a decrease of 55.56%.

Most of the fallen star companies, or even industry giants, died from the financial crisis caused by cash flow disruptions.

After a few years, a new and more tragic wave of industrial reshuffling is surging forward. According to data from Qichacha,

the number of registered energy storage industry enterprises has maintained a high-speed growth trend over the past decade (2014-2023), especially since 2022, with an annual increase of over 40000 registered enterprises.

As of the end of 2023, the total number of registered energy storage industry enterprises has reached 157600, an increase of 13.33 times compared to the decade (2014).

By 2024, the number of newly registered energy storage enterprises in the first half of the year alone will reach 40200.

In the two and a half years from 2022 to the first half of 2024, the total number of newly registered energy storage enterprises in the industry will reach 155800.

As of the end of June 2024, the number of registered energy storage enterprises has soared to 191000.

According to data from the 24 Tide Industry Research Institute (TTIR), as of now, in the six core tracks of power batteries, energy storage batteries, positive electrode materials, negative electrode materials, electrolytes,

and lithium battery separators, known enterprise production capacity plans far exceed the upper limit of market demand forecasts by third-party research institutions in 2025.

It seems that a major industrial reshuffle in the next three years is inevitable.

The competition has reached a deep water zone, and many companies are on the brink of survival.

We believe that in the current industry situation, the importance of financial health cannot be overemphasized.

Faced with the cold winter of the industry, financially healthy companies will have sufficient ammunition to weather the cycle and become winners,

while those financially fragile companies will face severe tests, and the risk of debt default or even bankruptcy cannot be ruled out.

Therefore, the 24 Tide Industry Research Institute (TTIR) believes that at this point, studying and analyzing the financial health index of Chinese lithium battery listed companies is of great significance for operators, creditors,

investors, governments, and other aspects.

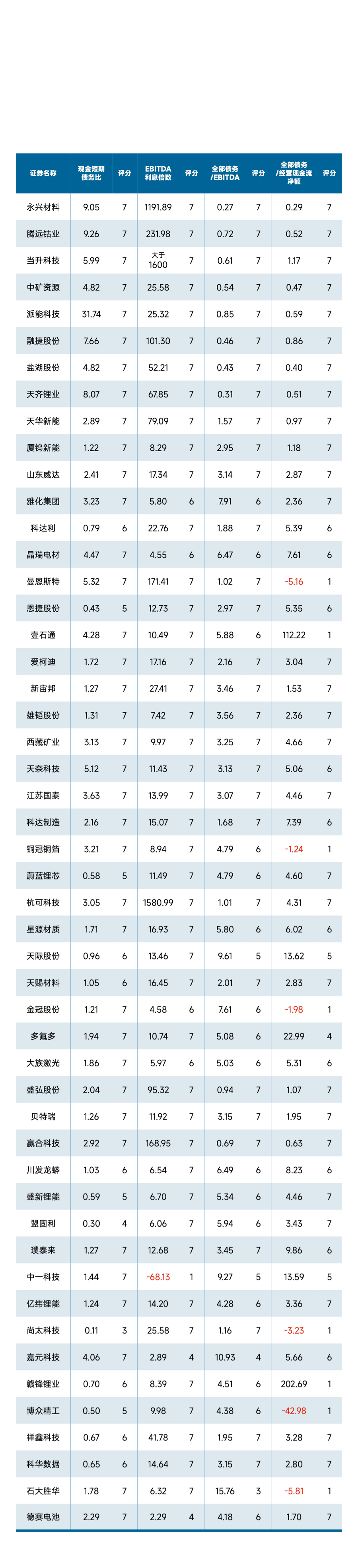

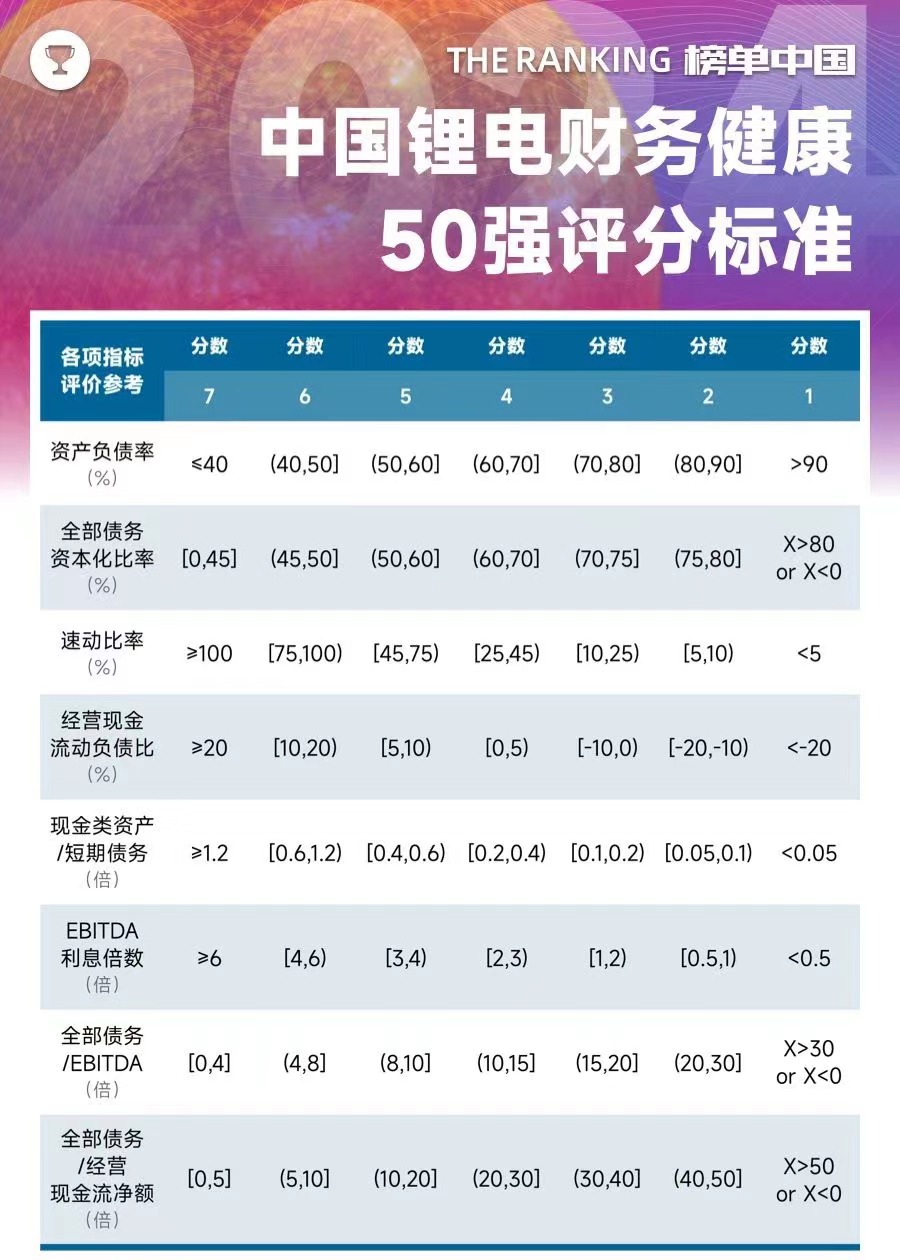

In this article, the 24 Tide Industry Research Institute (TTIR) refers to relevant practices such as subject credit rating and bond credit rating, and based on: 1.

Capital structure, including asset liability ratio and total debt capitalization rate; 2.

Debt paying ability, covering two dimensions including quick ratio, operating cash flow liability ratio, cash assets/short-term debt, EBITDA interest multiple, total debt/EBITDA,

and total debt/operating cash flow net, as well as eight core indicators (Q1 2024), has been compiled into the "Top 50 Financial Health Enterprises of China Lithium Battery (2024)" list.

We believe that this list can provide readers with a more intuitive and in-depth understanding of the financial health of enterprises,

and the specific indicator weights and ratings are detailed in the table below. We also welcome readers to provide corrections and supplements.