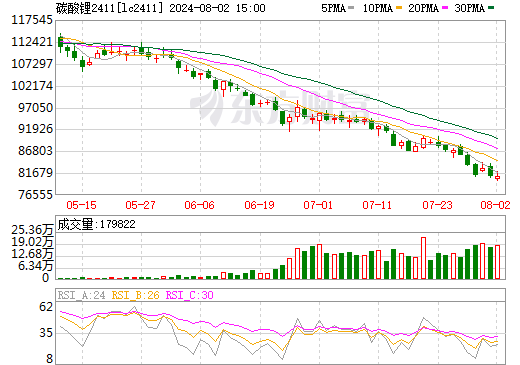

Lithium carbonate bearish 75000

Aug,05,24

On August 2nd, SMM data showed that the spot price of lithium carbonate fell significantly this week,

with the SMM battery grade lithium carbonate index price dropping from 84130 yuan/ton to 81582 yuan/ton, a decrease of 2548 yuan/ton.

The center of gravity of the spot market transaction price of lithium carbonate continues to shift downwards.

Under the current price trend, there has been a slight increase in inquiries from material factories this week.

However, due to the current strong pricing sentiment among lithium salt factories considering their cost issues,

there is still a certain gap in expected transaction prices between upstream and downstream.

Moreover, the current long-term contract and customer supply of the material factory can meet basic production needs, and the demand for essential procurement is weak.

The spot trading market for lithium carbonate still shows a relatively sluggish trend.

In the current situation of oversupply of lithium carbonate, it is expected that the price of lithium carbonate will continue to operate weakly.

Shanghai Steel Union released data showing that on August 2nd,

the price of battery grade lithium carbonate fell by 1000 yuan compared to the last time, with an average price of 79500 yuan/ton.

In terms of futures, lithium carbonate opened high and fell low on August 1st, with the main futures LC2411 closing at 80850 yuan/ton, a daily decline of 2.3%.

On August 2nd, the main futures of lithium carbonate, LC2411, fell slightly by 0.92% to close at 81000 yuan/ton.

According to analysis by Everbright Futures, on the supply side,

there is currently no significant slowdown in domestic production, and there has been a slowdown in overseas imports of resources and lithium salts,

but the overall supply level remains relatively high. On the demand side,

August is still the off-season, and the preliminary production of positive electrode materials is expected to slightly decrease compared to the previous month.

The sales performance of terminal new energy vehicles is also relatively average. In terms of inventory, the overall inventory level continues to increase, and structurally speaking,

the increase is mainly in other links.

Recently, futures prices have rapidly fallen to a new low, but the fundamentals remain weak, and continuing to chase short has lower cost-effectiveness.

Wang Chuhao, an analyst at Changan Futures,

believes that the supply and demand pattern of the lithium carbonate market remains a key factor affecting price trends due to the recent acceleration of the market's bottoming out.

On the one hand, the policy of doubling the old for new subsidies may not be as effective as expected,

and growth requires a certain amount of time to be transmitted.

In the short term, the fundamentals remain strong in supply and weak in demand.

On the other hand, the increasing supply of mines and salt lakes worldwide has further intensified market competition.

Lin Jiayi, an analyst at Guangfa Futures, also stated that under the continued influence of weak fundamentals,

short funds are constantly trying to bottom out, and long stop losses are further putting pressure on market prices.

Has the current price of lithium carbonate hit bottom? Li Rui, a senior researcher at Fubao Lithium Battery,

believes that there is still further downward momentum in the short-term price of lithium carbonate,

as the price of lithium carbonate has not yet forced the mining industry to clear its production capacity.

The pricing model of M-1 in March resulted in a significant lag in the prices of the mining and salt ends, and the profit from lithium extraction increased significantly to 20000 yuan/ton.

Under the excess profit, the shipping volume of Australian mines increased significantly.

In addition, domestic salt factories actively intervened in hedging, and after locking in the sales price of over 110000 yuan/ton,

the operating rate was increased to full capacity, and the lithium mine inventory was converted into lithium salt through the OEM model.

Li Rui said that from a fundamental perspective, the profit from lithium extraction has already been inverted, but there has been no large-scale production reduction or shutdown in salt factories.

The weakness of lithium carbonate fundamentals is mainly reflected in supply pressure.

In terms of supply, there has been a recent replenishment of imported raw materials at the port, and it is expected that the marginal increase in supply will gradually slow down after August.

Last week's weekly production data slightly decreased. According to SMM data,

the monthly production of lithium carbonate in July is expected to be 66705 tons, an increase of 462 tons from the previous month and a year-on-year increase of 47.2%.

As of July 25th, the weekly production of SMM lithium carbonate was 14573 tons, a decrease of 136 tons compared to the previous week.

Lin Jiayi expects that the demand side will be weak in the short term, and the battery production schedule in June will continue to weaken.

There may be an improvement in the price of three yuan in July.

Large factories still rely mainly on long-term customer supply, while mainstream battery cell factories have weak demand for materials,

making it difficult for demand to show significant improvement in the face of high inventory pressure and average downstream orders.

According to SMM data, the monthly demand for lithium carbonate in July is expected to be 64925 tons, a decrease of 3.48% compared to the previous month.

The expected production of ternary materials in July is 57400 tons, an increase of 8055 tons from the previous month and a year-on-year increase of 0.76%;

The monthly production of lithium iron phosphate is expected to be 172960 tons, a decrease of 4% compared to the previous month and an increase of 25% year-on-year.

It is worth noting that in mid to late August, the peak season for stocking up has entered, and currently inventory has significantly strengthened.

According to SMM data, as of July 25th, the total weekly inventory of the sample was 124156 tons, with smelter inventory of 55840 tons,

downstream inventory of 29863 tons, and inventory in other links of 38453 tons.

In terms of warehouse receipts, the recent volume of warehouse receipts has remained above 27000 and continues to increase, with a total of 32177 as of July 30th.

Li Rui believes that a substantial contraction in supply requires a reduction in production at the mining end,

but the current price of lithium carbonate has not yet forced the mining end to clear its production capacity.

According to him, the market usually takes the average cost of Yichun mica and African mines as the first cost support line, around 83000 yuan/ton,

but has not yet reached the common cost line of Australian mines.

Australian mining companies have significantly reduced costs,

and it is expected that Mt Marion's FOB cost in the 2024 fiscal year will be AUD 512 per ton (calculated as AUD 750 per ton based on SC6),

lower than the previous guidance value of AUD 900 per ton. Pilbara Minerals' Q2 production increased by 39% year-on-year to 226200 tons,

while unit operating costs (CIF) decreased by 26% year-on-year to $483.

Salt factories will only lower their operating rates, and after the accumulation of ore inventory, it will be converted into social inventory of lithium carbonate after price rebound.

Most Australian miners are listed companies, and selling lithium ore at low prices affects their investment and financing plans and market value, so they will not easily stop production.

"Li Rui said that only when the selling price is lower than the cost,

there is a possibility of comprehensive capacity contraction. Clearing 30% of production capacity corresponds to a complete cost of 75000 yuan/ton of lithium carbonate,

which is about to become a reality.

From the perspective of raw materials, the overall price of raw materials has also shown a downward trend, with a significant decrease in the average prices of spodumene and mica last week.

Data shows that as of July 30th, the average CIF price of 6% spodumene concentrate was $921 per ton, a decrease of $34 per ton from last week;

The average grade of lithium mica decreased by 5.04% to 1225 yuan/ton for grades ranging from 1.5% to 2%, and by 3.95% to 1883 yuan/ton for grades ranging from 2% to 2.5%.

At present, the procurement circulation of spodumene is better than that of mica, mainly due to the overall low operating rate of mica caused by cost issues.

It is expected that the raw material prices will fall along with the finished products in the short term.

According to industry insiders, the continuous downward shift of the cost center caused

by the decline in lithium salt production costs and raw material prices since March this year also proves the failure of cost support theory.